From left to right:

Stephen M. Scherr

David M. Solomon

John E. Waldron

From left to right:

Stephen M. Scherr

David M. Solomon

John E. Waldron

Last year was extraordinary in so many ways. Throughout my more-than-35-year

career, there have always been disruptions, but this year saw a healthcare crisis that had a personal impact on millions. The contrast between the hardship imposed on all those affected by COVID-19 and the very high level of market activity created a stark and complex environment for all of us at Goldman Sachs to navigate.

The pandemic put enormous strain on everyone, from families caring for relatives they couldn’t visit in person to small-business owners forced to cut back their livelihoods. And though I was pleased to see central banks and governments take swift action to support their economies, no amount of monetary or fiscal stimulus could make up for the millions of lives lost or upended by the virus.

As I write this letter, we’re still working to get past the pandemic, but we feel encouraged by what we see. Several vaccines have been approved for use, and though the rollout was slow at first, we continue to make headway. Public-health officials are closely monitoring the spread of more contagious variants. But the global economy has recovered considerably since its decline last spring, and now life after the pandemic is coming into view.

Many times in our 152-year history, we’ve adapted, with remarkable speed, to the new and unexpected, but I was truly amazed by our people in 2020. Time and again, they showed the creativity and resilience that make Goldman Sachs unique. As a result, I’m proud to report that, even during a tumultuous and at times deeply trying year, our firm delivered strong financial performance, while also supporting the larger COVID-19 relief effort for the communities in which we live and work around the world.

For all of this year’s upheaval, we distinguished ourselves by staying the course. We never lost sight of our purpose: to advance sustainable economic growth and financial opportunity. And when our clients turned to us in need, we demonstrated the core values that have always guided us: partnership, client service, integrity, and excellence.

I was also determined to resolve the matter surrounding 1Malaysia Development Berhad (1MDB). Although I am glad to have put it behind us, I see many lessons for the future. Notably, the behavior of a few can do harm to our franchise, and we are responsible for each other’s actions. And so our organization will continue to make sure all of us operate at the highest level of integrity.

For our people, overcoming the immense challenges of 2020 was all-consuming, and so I owe them a great deal of gratitude. My thanks go out to our leadership, including our president and chief operating officer, John Waldron; our chief financial officer, Stephen Scherr; our entire Management Committee; and, most of all, to the people at every level who make Goldman Sachs such an extraordinary firm.

Speaking of our people, they truly went above and beyond in 2020. The numbers alone don’t tell the full story

of what they accomplished, because they mask the deep uncertainty our people faced.

Investor Day

On January 29, 2020, we held our first-ever Investor Day, where we laid out to the public our strategy as well as our medium- and long-term performance goals. It was well received, but alongside the positive reviews, we began seeing reports of a mysterious new virus that was spreading rapidly around the globe. I remember looking at our financial results one Friday night at the end of February 2020 and thinking that we were on track to have a very strong quarter. As you well know, the first quarter of 2020 was, in fact, historic. It just didn’t look anything like what I had expected halfway through.

Our preparation for Investor Day served us well. In January, we stressed repeatedly that we had assumed a normal operating environment in setting our targets. And yet we made good progress on nearly all of our goals during 2020. As I look back, it’s clear that because we had a strategy in place well before the pandemic hit, it gave our efforts a focus during the turmoil that ensued. Our performance this year proved the old adage that plans are worthless, but planning is everything.

Our People, Our Clients, and Our Communities

That was just one of the lessons I learned in 2020, or perhaps I should say “relearned.” The distinction is important because, to me, a lot of what I saw in 2020 wasn’t some bold departure from all that had come before, so much as an acceleration of trends already underway. For instance, where in previous years more and more employers had given their employees the option to work remotely, in 2020 far more of them did.

Likewise, when people ask me how we did it, how we showed such adaptability in the early months, setting the stage for the performance that followed, I find myself citing an old principle that, though it may seem trite, I know to be true: We put people first. From the moment we activated our business-continuity plan, we made sure to give our people the tools and resources they needed to take care of themselves, their families, our clients during the market volatility, and our communities as they responded to COVID-19.

First, we took care of our people. Within a few weeks, 98 percent of our nearly 40,000 employees were working remotely. To help them cope with the demands of working from home while also homeschooling their children and taking care of sick loved ones, we gave 10 days of family leave and began offering telemedicine free of charge. And to give them a much-needed mental break every now and then, our Wellness teams organized dozens of Zoom classes throughout the year that our people joined by the hundreds: fitness classes, yoga classes, even virtual story time for their families.

And while our leadership responded immediately, what was inspiring was how our people looked out for each other. I heard so many stories of our people pitching in, working together, and staying in touch through virtual tea sessions, cooking classes, and even singalongs. And while we adapted and formed new traditions, we also made sure to pass on our culture to the next generation when in July, we welcomed more than 2,700 summer analysts and 120 associates from more than 480 universities to Goldman Sachs, this time for a five-week remote experience.

Second, we were there for our clients, no matter what happened. That was perhaps most dramatically evident in March when an earthquake hit Salt Lake City and our colleagues in Bengaluru worked around the clock to process any incomplete transactions. Just because we couldn’t meet face to face didn’t mean we’d stop working with our clients one-on-one — even in an era of Zoom fatigue. And I know how much our clients appreciated it. I remember in the summer exchanging messages with a client just before a meeting to discuss potential capital-raising options; they told me they were looking forward to it because they knew they would get candid and thoughtful advice.

Being there for our clients also meant giving them the help they needed, whether it was the liquidity our Global Markets teams provided or the customer-assistance program we created for our Marcus and Apple Card consumers. We allowed consumers to skip several months’ payments with no interest. And we partnered with clients in New York to offer interest-free loans of up to $75,000 to small businesses in the area to help them get through the tough early months of the pandemic.

Third, we helped take care of our communities, starting with our first responders and healthcare workers. We donated over 2.5 million surgical masks and 700,000 N95 masks from our own supplies, and we developed a dashboard for the United Kingdom and its National Health Service to monitor the spread of COVID-19. We also partnered with the Northwell Hospital System and local restaurants to set up hydration stations and provide food for frontline healthcare workers in the U.S. I had to see it for myself, so in May I went to Plainview, Long Island, and spent time making sandwiches at Coliseum Caterers before delivering them to Plainview Hospital, where I was deeply moved to see our healthcare workers’ steadfast devotion to their patients.

Perhaps our most vital project was helping our hardest- hit communities. We committed $775 million to providing loans through the Paycheck Protection Program (PPP), as we sought to push money through Community Development Financial Institutions and into the hands of small businesses — particularly in communities of color. Nearly half of the PPP loans funded with Goldman Sachs capital in round 1 went to communities of color.

Among our leadership team, we felt putting people first meant that, especially in those early months when information was scarce, we needed to place an even greater emphasis on communication. Every month, we held a virtual town hall, where we updated our people on what we were doing to address the crisis, and I sent to our team around the globe voice notes that I recorded from my desk phone on numerous Sunday nights, so our people could hear from me in my own words. I also realized that sometimes the strongest message you can send is just by showing up, so I continued to go in to the office at 200 West Street in New York, even during the grim months of March and April. I felt it was good for our people to know our leadership was in control and ensuring that we would navigate the challenges of the pandemic.

Now, our focus is on making sure all of our people can safely return to the office. In giving our people the flexibility to work remotely, we did what we had to do.

But I am keenly aware of the impact that a prolonged absence from the office is having on our people, our culture, and our ability to move forward as a firm.

The culture of our organization is deeply rooted in apprenticeship, collaboration, and innovation, all of which occur far more naturally when we work together in person, on a regular basis. We owe it to the people who have just joined the firm to ensure that, as we continue on this journey together, we will find ways for them to develop and grow, whether it’s through the opportunity to network, find a mentor, or simply benefit from being around so many other smart, creative people. It’s the best way to learn our culture and the business, especially if you’re an intern or a recent hire. Now, making sure all of our people can return to the office safely will be a priority of mine in the months ahead.

So when you widen the lens a bit, it becomes even more clear just how much we accomplished in 2020, and also how much further we have to go. This is a marathon, not a sprint, and though progress is never a straight line, this year more than any other taught us that, when your strategy is clear — even in a crisis — you’ve got to stay the course.

In 2020, economic activity dropped suddenly in the first half of the year before largely recovering in the second, causing turmoil in financial markets, especially in the spring.

Through it all, we stood by our clients. We provided liquidity, credit, and relief to corporates, institutions, and consumers as much as possible during this most challenging time. Net revenues grew by 22 percent to $44.6 billion, our highest in 11 years. Diluted earnings per share (EPS) was $24.74, the second highest ever. Return on average common shareholders’ equity (ROE) was 11.1 percent, and return on average tangible common shareholders’ equity was 11.8 percent. During 2020, the firm recorded net provisions for litigation and regulatory proceedings, driven by the 1MDB matter, of $3.42 billion, which reduced diluted EPS by $9.51 and ROE by 3.9 percentage points.

Amid significant market volatility, not only did the industry wallet grow, but we gained market share across our capital markets businesses. In Investment Banking, we generated net revenues of $9.4 billion, 24 percent higher than in 2019, as we held the #1 ranking in both announced and completed M&A and in equity and equity-related offerings.1 We also ranked in the top 4 for wallet share in debt underwriting.2 In Global Markets, we earned net revenues of $21.2 billion, our strongest in a decade, and ranked #2 both in Fixed Income, Currency and Commodities (FICC) and in Equities.3 Asset Management generated net revenues of $8.0 billion as we saw record management and other fees. And Consumer & Wealth Management generated record net revenues of $6.0 billion, as Wealth management produced record net revenues and Consumer banking net revenues were significantly higher than in 2019. The firm ended the year with record assets under supervision and, in Consumer & Wealth Management, total client assets4 exceeded $1 trillion.

We learned a lot about humility in 2020 because so much of what happened was out of our control, but the progress we made on our performance goals is a testament to the strength of our people and our strategy. As described on Investor Day, we continue to build a firm capable of generating mid-teen or higher returns over the long term. And in the medium term — that is, by 2022 — we are confident that we will reach our targets: In 2020, our ROE was 11.1 percent, notwithstanding a nearly four percentage-point impact of litigation expense, compared with our 13 percent medium-term target. Our efficiency ratio was 65 percent, above our target of around 60 percent, but that included a nearly 800 basis-point impact from litigation expense. And our standardized Common Equity Tier 1 ratio stands at 14.7 percent, versus our targeted range of 13 percent to 13.5 percent.

So while Investor Day seems like a long time ago, the pillars of our long-term strategy remain the same, and I’m proud to report we are seeing early success in each category:

• First, to grow and strengthen our existing franchise and capture higher wallet share across a wider range of clients;

• Second, to diversify our products and services in order to build a more durable source of earnings;

• Third, to operate more efficiently so that we can drive higher margins and returns across the organization.

We’ve helped steer clients through stormy market conditions for decades, and though the economic waters were especially choppy in 2020, by putting our clients first, all four of our core businesses not only weathered the downturn, but saw real growth.

Investment Banking

We remained the advisor of choice and continued to grow our businesses, as our announced M&A deal count was up, along with our equity underwriting wallet share. We also continued to seek out opportunities for growth, especially among companies we haven’t covered as much in the past. Thanks to our footprint-expansion efforts, we added approximately 300 clients and generated more than $800 million in revenue in 2020. With our year-end investment-banking-transaction backlog near record levels — and significantly higher than it was at the end of 2019 — we feel our franchise has momentum going into 2021, as M&A, among other strategic activity, continue to pick up steam from the slump they hit in the middle of 2020.

Global Markets

When our new management team took their seats, there were calls to downsize our Global Markets business, but we believe its performance in 2020 shows it was wise to stay the course. Our teams worked diligently to serve our clients, providing liquidity across asset classes, intermediating risk, and engaging in structured solutions while also supporting significant volumes across expanding digital platforms. We improved returns by pursuing expense and resource optimization and made progress toward the growth targets we set last year. We are now in the top 3 across 64 of the top 100 institutional clients, up from 51 a year ago.5 We earned record financing revenues in FICC and also ended the year with record balances in our prime services business.

Asset Management

Our reputation as a leading global asset manager served us well during this tumultuous year. Clients turned to us for advice, and we grew firmwide assets under supervision by $286 billion during the year to an all-time high of $2.15 trillion, earning record management and other fees. Our business continues to provide offerings across the spectrum from liquidity to alternatives, and we continue to distinguish ourselves by offering holistic advice, investment solutions, and portfolio implementation.

Consumer & Wealth Management

We also saw growth in our Consumer & Wealth Management business, as total client assets rose by approximately $180 billion to a record of more than $1 trillion. Even in the midst of a volatile market, our clients stayed largely invested, and net revenues in Wealth Management grew by 10 percent year-over-year to a record $4.8 billion. We’ve once again seen just how much clients trust our franchise, which became even more important as COVID-19 limited face-to-face interaction.

Despite the turmoil in financial markets, we continued to serve our clients well, and we made progress in our effort to build more durable revenues, increase capital efficiency, and enhance our funding mix by forging ahead on our four new business initiatives.

Transaction Banking

After we formally launched our transaction banking platform in June, we saw tremendous growth. We ended 2020 with roughly 225 corporate clients and nearly $30 billion in deposits — more than half of our five-year target of $50 billion. Now, we will continue to expand services to transform these deposits to be operational. The most promising are the partnerships we’ve formed with other companies, such as Stripe, which embed our transaction banking, payment, and deposit solutions directly into their own platforms, making them available to their millions of customers.

Third-Party Alternatives

In alternatives, we have raised approximately $40 billion in gross commitments across asset classes, including private equity, private credit, and real estate. This is good progress toward our goal of $150 billion in gross fundraising over five years. In addition, we are seeing our list of clients grow constantly. Many pension funds and international institutions participating in recent fund offerings are new investing clients of the firm. And to optimize capital consumption within Asset Management, we sold or announced the sale of over $4 billion of equity investments in 2020 with a related $2 billion in expected reduction of required capital.

High-Net-Worth Wealth Management

Even while we slowed down our hiring efforts because of the pandemic, we added more than 100 client-facing professionals and continued to expand our high-net-worth platform through our Personal Financial Management business, formerly known as United Capital, and Ayco. Ayco continues to earn praise for its corporate-employee financial-planning services and gained 33 new corporate clients this year. In a demonstration of the power of our One Goldman Sachs approach, synergies across and connectivity with these channels resulted in over 4,000 internal referrals, representing an opportunity to gather over $7 billion in assets under supervision.6 Today, we have integrated offerings for corporates from the executive suite on down.

Digital Consumer Banking

We saw strong growth in our digital consumer bank, as consumer deposits rose by $37 billion to $97 billion in total, and in April we reached our one-millionth deposit customer in Marcus. Not long after, I picked up the phone and called this customer — and was delighted to hear how satisfied he was with our service. We saw early success with our online savings, lending, and credit card offerings, and in 2020, we launched four partnerships with Amazon, Walmart, JetBlue, and AARP. We also recently announced our second co-branded credit card with General Motors, another sign of our ability to be the banking partner of choice for leading corporations across a variety of industries. In 2021, with the benefit of a strong team, we plan to launch in the U.S. new digital checking accounts and have already launched our new Marcus Invest platform, which brings the investing expertise of Goldman Sachs directly to mass affluent customers. We plan to expand the platform to the U.K. later in the year.

On Investor Day, we set a target of $1.3 billion of annual run-rate expense efficiencies over the medium term, and we achieved approximately half of that goal in 2020. With the money saved, we partially offset the investments made in our business and our people in 2020.

Our experience over the past year has given us even greater confidence in several of the key elements of our plan. In particular, we are already seeing important benefits from our investments in automation and consolidation of platforms, including increased straight-through processing rates and reduced cost per trade.

In addition, we continue to generate efficiencies from structural adjustments to our employee base through our front-to-back realignment, location strategy, and the reshaping of our pyramid structure. The transition to remote work has also increased our focus on our location strategy. Last January, we expected that 40 percent of our employees would ultimately work from one of our strategic locations, and we will continue to evaluate the potential for that number to grow over time. We will also look to expand into new strategic locations around the globe, as well as consolidate our footprint, where appropriate.

The uncertainty and dislocation of the healthcare crisis amplified how important it is that we invest in the fabric of our society, make it more sustainable, and advance inclusive growth. While some feared the crisis would soften sustainability ambitions or slow investment, in fact investors and companies set bold new ambitions and redoubled their efforts.

Climate Transition and Inclusive Growth

In December 2019, we announced our commitment of $750 billion over 10 years to financing, investing, and advisory activity across two core pillars of sustainable finance: climate transition and inclusive growth.

A little more than a year later, we have made good progress. We have fully integrated our approach throughout our businesses. For example, we have launched partner-led sustainability councils within each of our divisions. We contributed over $150 billion in sustainable-finance activity over the course of 2020, including over $90 billion toward climate transition. And to show our clients we believe in these solutions just as much as they do, we issued our first-ever sustainability bond in February 2021.

Still, the challenge of climate change is massive; it cannot be addressed by one company alone. That is why we have long advocated for the United States to rejoin the Paris Agreement and are committed to delivering on its ambitious goals, including by aligning our financing activities with a net-zero-by-2050 pathway.

And while long-term aspirations are important, business leaders must not lose sight of what we can do in the here and now to accelerate climate transition. For our part, in addition to driving capital to climate solutions and accelerating the climate transition of our clients, we’re advancing on three separate fronts.

First, we’re working to develop more comprehensive climate data and to promote more thorough disclosure. We have joined the OS-Climate initiative as its founding U.S. bank member to develop an open-source data commons and net-zero alignment tools that can be used across industries.

Second, on top of the long-term goals we’ve set, we’re developing near-term goals to further speed up progress. We’ve joined the U.N. Principles for Responsible Banking to make sure our strategy is in line with the Paris Agreement goals.

And third, we continue to weave climate-risk considerations into how we do our business. Later this year, we will issue our second annual Taskforce on Climate-related Financial Disclosure (TCFD) report, in which we will lay out in detail how we’re taking climate-risk considerations into account both in our business practices and our business selection.

I’m proud of the firm’s leadership in this area, and we will continue to deliver integrated sustainable solutions to help our clients navigate the transition.

Diversity and Inclusion

Just as vital to our business is advancing diversity and inclusion, not only at our firm, but also among our clients and in the world at large. In a demonstration of how essential we believe this effort to be both to our strategy and to our financial performance, we continued to make progress on our aspirational goals in 2020.

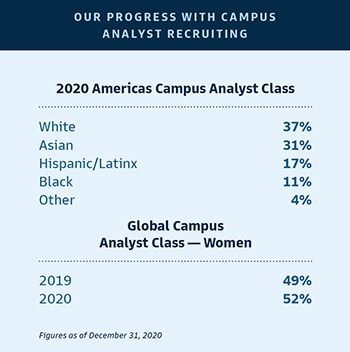

First, we attracted more diverse talent to Goldman Sachs than ever before. In our 2020 campus analyst class in the Americas, we achieved a historic first: 55 percent were women. Black talent made up 11 percent of the class, Hispanic/Latinx talent made up 17 percent, and Asian talent made up 31 percent.

But it’s not enough to recruit talent; we also need to make sure they can realize their potential, so we’ve set additional goals to hold ourselves accountable. By 2025, we aim for 7 percent of our vice presidents in both the Americas and the U.K. to be Black, 9 percent of our vice presidents in the Americas to be Hispanic/Latinx, and 40 percent of our vice presidents across the world to be women. In addition, we were pleased to announce that our most recent partner and managing director classes were the most diverse in our firm’s history.

Second, we embraced our responsibility as a leader in our industry to promote change. In July 2020, we began a new policy to only underwrite initial public offerings for companies domiciled in Western Europe and the U.S. that have at least one diverse board member. The feedback we’ve received from clients and investors has been overwhelmingly positive, and in July 2021, we will raise that figure to two.

Third, we added our voices to calls for racial equity. In the wake of senseless acts of racism against Black people, I issued a statement reiterating that discrimination has no place at Goldman Sachs. We also developed training to cultivate allies for racial equity. I, along with every member of our Management Committee, have experienced the ongoing benefit of one-on-one reverse mentoring from our Black leaders. And to do our part in the wider community, we created the $10 million Fund for Racial Equity to support the work of leading organizations fighting racial injustice and structural inequity.

Advancing diversity and inclusion is a priority of mine, and all of our people are committed to making even further progress in the year ahead.

One Million Black Women

Building on our commitment to advance sustainable and inclusive economic growth, as well as our 20-year history of investing significant capital in Black communities, we were excited to launch in March 2021 our newest initiative, One Million Black Women. We will make a unique contribution to advancing racial equity by investing $10 billion through the lens of Black women and narrowing opportunity gaps for 1 million Black women. Our investments will focus on increasing opportunity at key moments in Black women’s lives, whether it’s by expanding access to quality healthcare, modernizing daycare and primary school facilities in Black communities, or providing access to capital to grow a business, among other things.

This effort can’t succeed without advice and counsel from the broadest range of Black voices possible, so we’ve created a new advisory council of prominent Black leaders from a wide range of fields. There has never been an investment of this size focused on Black women, and we are proud to bring people together in this historic effort.

Goldman Sachs 10,000 Small Businesses

As part of our investment in communities, we are also helping the entrepreneurs who create the long-term economic growth we need. Our signature entrepreneurship initiative, Goldman Sachs 10,000 Small Businesses, reached a milestone in 2020, surpassing our goal of serving 10,000 business owners through our education program. Over the past 10 years, our graduates have taken the knowledge they’ve acquired from our program and applied it to their businesses, creating jobs and opportunity in the communities where they live and work. To redouble our support for small businesses, we announced an additional $250 million commitment in 2020 to serve an additional 10,000 entrepreneurs.

We have also been helping small-business owners drive change through advocacy. In 2020, we launched 10,000 Small Businesses Voices, a new initiative that helps alumni of 10,000 Small Businesses advocate for policy changes that will help their businesses, their employees, and their communities. We provide the 10,000 Small Businesses Voices community with the tools, resources, and training needed to make their voices heard and have a direct impact on critical issues.

After a difficult year, we are cautiously optimistic about 2021. Much depends on the effort to slow the spread of the virus, how quickly vaccines are distributed, whether monetary and fiscal stimulus is maintained, and whether geopolitical risks intensify. But Goldman Sachs will continue to help an ever-widening range of clients and develop more durable revenue sources.

I am incredibly proud of the progress we made in 2020, and we never would have done it without the extraordinary efforts of our people. I am humbled by the commitment I see across our firm every day. This year had its fair share of challenges, but I am optimistic about the potential for Goldman Sachs in the coming years. I believe in our strategic plan, our leadership team, our culture, and in the raw talent of our people. Together, they will all help us achieve higher and more sustainable returns for our shareholders.

David M. Solomon

Chairman and Chief Executive Officer

Our Core Values

We distilled our Business Principles into 4 core values that inform everything we do:

Partnership | Client Service | Integrity | Excellence

Goldman Sachs Business Principles

Our clients’ interests always come first.

Our experience shows that if we serve our clients well, our own success will follow.

Our assets are our people, capital and reputation.

If any of these is ever diminished, the last is the most difficult to restore. We are dedicated to complying fully with the letter and spirit of the laws, rules and ethical principles that govern us. Our continued success depends upon unswerving adherence to this standard.

Our goal is to provide superior returns to our shareholders.

Profitability is critical to achieving superior returns, building our capital, and attracting and keeping our best people. Significant employee stock ownership aligns the interests of our employees and our shareholders.

We take great pride in the professional quality of our work.

We have an uncompromising determination to achieve excellence in everything we undertake. Though we may be involved in a wide variety and heavy volume of activity, we would, if it came to a choice, rather be best than biggest.

We stress creativity and imagination in everything we do.

While recognizing that the old way may still be the best way, we constantly strive to find a better solution to a client’s problems. We pride ourselves on having pioneered many of the practices and techniques that have become standard in the industry.

We make an unusual effort to identify and recruit the very best person for every job.

Although our activities are measured in billions of dollars, we select our people one by one. In a service business, we know that without the best people, we cannot be the best firm.

We offer our people the opportunity to move ahead more rapidly than is possible at most other places.

Advancement depends on merit and we have yet to find the limits to the responsibility our best people are able to assume. For us to be successful, our people must reflect the diversity of the communities and cultures in which we operate. That means we must attract, retain and motivate people from many backgrounds and perspectives. Being diverse is not optional; it is what we must be.

We stress teamwork in everything we do.

While individual creativity is always encouraged, we have found that team effort often produces the best results. We have no room for those who put their personal interests ahead of the interests of the firm and its clients.

The dedication of our people to the firm and the intense effort they give their jobs are greater than one finds in most other organizations.

We think that this is an important part of our success.

We consider our size an asset that we try hard to preserve.

We want to be big enough to undertake the largest project that any of our clients could contemplate, yet small enough to maintain the loyalty, the intimacy and the esprit de corps that we all treasure and that contribute greatly to our success.

We constantly strive to anticipate the rapidly changing needs of our clients and to develop new services to meet those needs.

We know that the world of finance will not stand still and that complacency can lead to extinction.

We regularly receive confidential information as part of our normal client relationships.

To breach a confidence or to use confidential information improperly or carelessly would be unthinkable.

Our business is highly competitive, and we aggressively seek to expand our client relationships.

However, we must always be fair competitors and must never denigrate other firms.

Integrity and honesty are at the heart of our business.

We expect our people to maintain high ethical standards in everything they do, both in their work for the firm and in their personal lives.

Forward-Looking Statements

This letter contains forward-looking statements, including

statements about our financial targets, business initiatives,

and operating expense savings. You should read the

cautionary notes on forward-looking statements in our

Form 10-K for the period ended December 31, 2020.

Endnotes

1 Source: Dealogic – January 1, 2020, through December 31, 2020.

2 Measured by reported revenues, per peer filings as of December 31, 2020. Peers include JPM, BAC, C, MS, CS, DB, and BARC.

3 Source: McKinsey institutional client analytics for 3Q20 YTD. Analysis excluded captive wallets.

4 Total client assets includes assets under supervision, brokerage assets, and consumer deposits.

5 Sources: Client Ranking/Scorecard/Feedback and/or McKinsey revenue ranking (data as of 1H20 or 3Q20, as applicable).

6 Represents bilateral referrals between Private Wealth Management and Personal Financial Management and eligible

Corporate employees referred to Personal Financial Management.